The 23rd World Insights

Exploring the untold stories and events from around the globe.

Riding the Wave: How Marketplace Liquidity Models Keep Your Business Afloat

Discover how marketplace liquidity models can keep your business thriving and navigate the waves of uncertainty. Your competitive edge awaits!

Understanding Marketplace Liquidity: The Key to Sustainable Business Growth

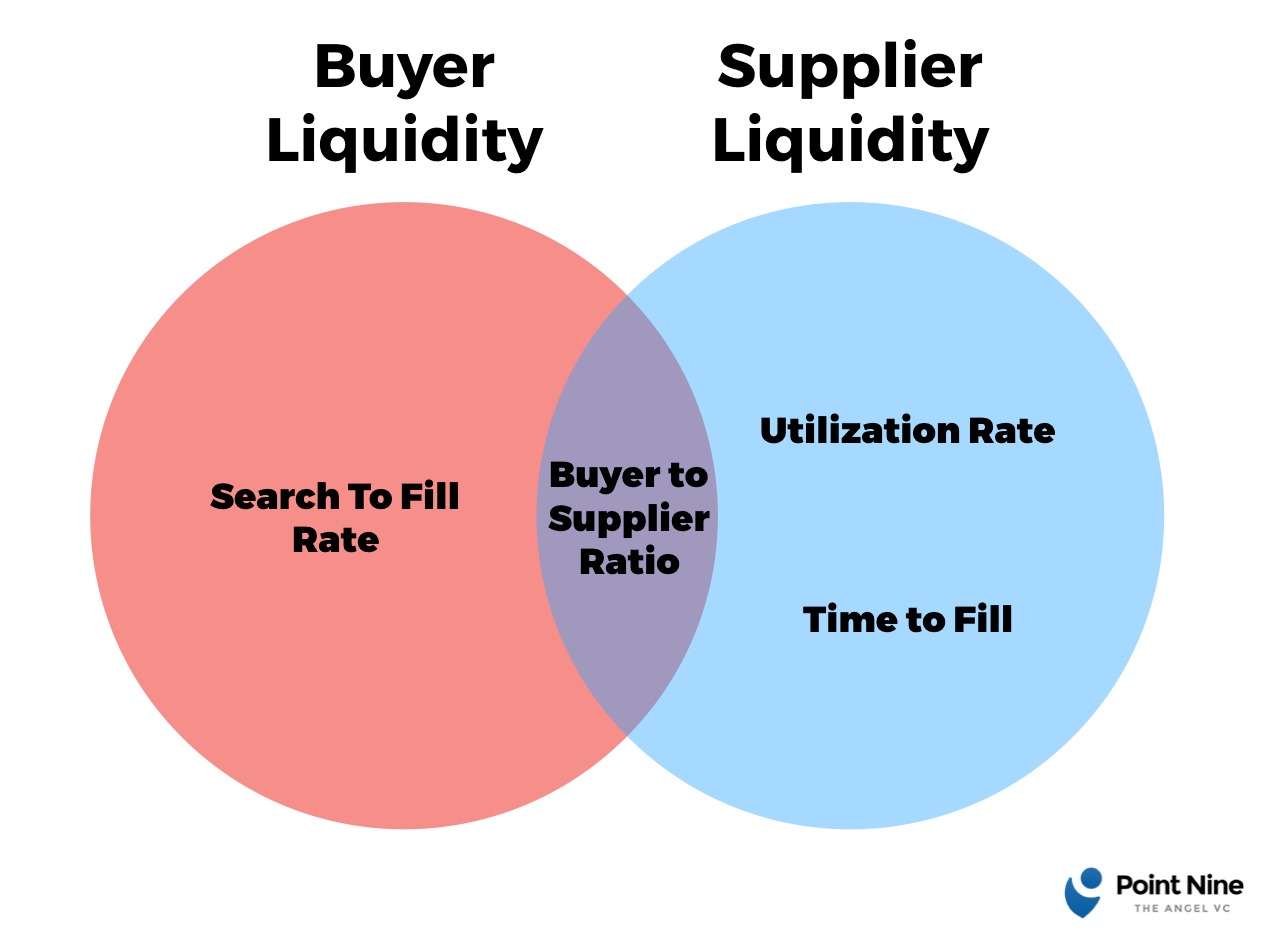

Understanding Marketplace Liquidity is essential for businesses aiming for sustained growth. Marketplace liquidity refers to the ease with which assets, products, or services can be bought and sold without causing significant changes in their price. In a highly liquid market, transactions occur smoothly, allowing for quick turnaround times and fostering customer trust. This fluidity not only enhances the buying experience for consumers but also enables businesses to adapt swiftly to market demands, thereby achieving sustainable business growth.

When evaluating a marketplace's liquidity, consider key factors such as transaction volume, market depth, and supply-demand dynamics. A high transaction volume typically indicates a healthy market, while substantial market depth ensures that even large orders can be executed without impacting prices significantly. Furthermore, understanding the underlying supply and demand trends allows businesses to strategize proactively, aligning their offerings with market realities, which is crucial for long-term success and profitability.

Counter-Strike is a highly popular first-person shooter game that pits teams of terrorists against counter-terrorists in various missions. Players can purchase weapons and equipment, and teamwork is essential for success. To enhance your gaming experience, you can use a daddyskins promo code to unlock exclusive skins and features.

The Impact of Liquidity Models on Your Market’s Success

The role of liquidity models is crucial in determining the success of any market, as they facilitate the ease with which assets can be bought or sold without causing significant price changes. A market with high liquidity generally allows for a quicker turnaround on investments and provides a more stable environment for traders and investors. Conversely, liquidity issues can lead to increased volatility and barriers to entry for new participants. Understanding how liquidity models function is essential for market stakeholders to devise strategies that can enhance their trading experiences and overall market health.

Furthermore, a well-implemented liquidity model can also lead to improved pricing accuracy and lower transaction costs, making a market more attractive to potential investors. For instance, markets that utilize advanced liquidity models can better accommodate large transactions without significantly impacting the market price. This can create a feedback loop where increased participation boosts liquidity, further attracting investors. As such, analyzing the impact of liquidity models on market success is not just advantageous but necessary for sustaining long-term growth and stability.

How to Optimize Your Business for Enhanced Marketplace Liquidity

Enhancing your business's marketplace liquidity is crucial for attracting potential buyers and increasing the overall efficiency of your transactions. Optimizing your business involves several key strategies that can help you navigate the market effectively. Firstly, ensure that your product listings are detailed and informative. This means utilizing high-quality images, comprehensive product descriptions, and relevant keywords that resonate with your target audience. A well-structured inventory that is easy to navigate also plays a significant role in enhancing liquidity, as it encourages more transactions.

Another effective method to boost liquidity is to utilize data analytics to monitor market trends and customer behavior. By analyzing this information, you can adjust your pricing strategies accordingly, making your offerings more attractive to buyers. Additionally, consider diversifying your payment options to accommodate a wider range of customers. Effective communication and engagement with customers can also foster loyalty and encourages repeat business, all of which contribute to a healthier liquidity position in the marketplace.