The 23rd World Insights

Exploring the untold stories and events from around the globe.

Marketplace Liquidity Models: The Unseen Engines of Online Commerce

Unlock the secrets of marketplace liquidity! Discover how these hidden engines drive online commerce success and boost your profits.

Understanding Marketplace Liquidity: Key Models and Their Impact on Online Commerce

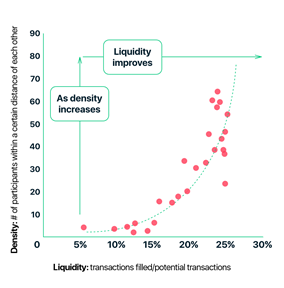

Understanding marketplace liquidity is crucial for both buyers and sellers in online commerce. Liquidity refers to the ease with which assets can be bought or sold in the marketplace without affecting the asset's price significantly. For instance, a marketplace with high liquidity allows transactions to occur quickly, ensuring that sellers can find buyers swiftly and vice versa. This notion is profound in sectors such as real estate, stock markets, and e-commerce platforms, where customer behavior and market dynamics significantly influence the trading environment.

There are several models to consider when analyzing marketplace liquidity, including order book, automated market maker (AMM), and decentralized exchanges (DEX). Each of these models impacts online commerce differently. For example, an order book model presents a transparent pricing layer where users can see all buy and sell orders, creating an organized system that enhances price discovery. Meanwhile, an AMM allows liquidity pools to foster trading without relying on traditional buyers and sellers, potentially increasing the efficiency of transactions in niche markets.

Counter-Strike is a popular multiplayer first-person shooter video game series that has captivated gamers since its inception. Players join either the terrorist or counter-terrorist team to complete objectives, and the strategic gameplay requires teamwork and skill. You can enhance your gaming experience by taking advantage of various in-game promotions, such as the daddyskins promo code, which can provide players with perks and bonuses.

How Do Liquidity Models Fuel the Success of E-Commerce Platforms?

Liquidity models play a crucial role in determining the success of e-commerce platforms by ensuring that transactions can occur smoothly and efficiently. These models help to enhance the availability of goods and services, providing users with instant access to what they need. When a platform operates with a well-structured liquidity model, it minimizes waiting times and maximizes customer satisfaction. For instance, a marketplace that effectively connects buyers and sellers ensures that inventory turnover rates are high, contributing to a vibrant and active shopping experience.

Moreover, liquidity models facilitate dynamic pricing and inventory management, which are essential for staying competitive in the fast-paced e-commerce landscape. By utilizing data-driven analytics and algorithms, e-commerce platforms can adjust prices in real-time based on demand and supply conditions, ensuring that they remain attractive to buyers while maximizing profits. In this manner, liquidity models do not just support transaction volume; they also promote strategic decisions that can lead to sustainable growth and stronger market positioning.

The Role of Market Makers: Unraveling the Mechanics of Marketplace Liquidity

Market makers play a crucial role in enhancing the liquidity of financial markets. These entities commit to buying and selling securities at specified prices, facilitating smoother transactions between buyers and sellers. By maintaining a continuous presence in the marketplace, market makers help to ensure that there is always a ready supply of assets available, which can prevent large price swings and foster a more stable trading environment. Their activities also contribute to tighter bid-ask spreads, enabling investors to enter and exit positions more efficiently.

Understanding the mechanics of marketplace liquidity involves appreciating how these participants operate. Market makers use sophisticated algorithms and real-time data analytics to manage their inventories and assess market conditions. They adjust their pricing in response to fluctuations in supply and demand, ensuring that they can provide competitive prices. Furthermore, they may engage in arbitrage strategies, exploiting price discrepancies across different markets to maintain balance. Overall, the presence of market makers is essential for fostering an efficient, liquid marketplace that benefits all traders.