The 23rd World Insights

Exploring the untold stories and events from around the globe.

Marketplace Liquidity Models: The Secret Sauce That Keeps Buyers and Sellers Dancing

Unlock the secrets of marketplace liquidity models! Discover how they create harmony for buyers and sellers in our latest blog post.

Understanding Marketplace Liquidity: How It Affects Buyer and Seller Behavior

Understanding marketplace liquidity is crucial for both buyers and sellers as it directly impacts their behavior and decision-making processes. Liquidity refers to the ease with which assets can be bought or sold in a marketplace without affecting the asset's price. When liquidity is high, buyers can purchase goods quickly and sellers can offload their inventory without significant delays. This dynamic creates a market where participants feel confident in their transactions, leading to increased trading volumes and stable prices. Conversely, low liquidity can result in price volatility, making buyers hesitant and sellers more cautious about setting their prices.

Furthermore, the effects of marketplace liquidity extend beyond mere transactions; they shape the overall market experience. Buyers are more likely to engage in purchasing when they perceive a liquid market, as it provides the reassurance that they can exit their positions readily if needed. On the other hand, sellers are incentivized to list their products at competitive prices to attract buyers quickly. In summary, the relationship between liquidity and market participant behavior is interdependent, where both buyers and sellers must navigate this landscape to optimize their trading strategies and maximize their potential outcomes.

Counter-Strike is a popular first-person shooter game that pits teams against each other in various objective-based scenarios. Players can enhance their gaming experience by utilizing a daddyskins promo code to unlock skins and other items. The game's strategic depth and competitive nature have made it a staple in the esports community.

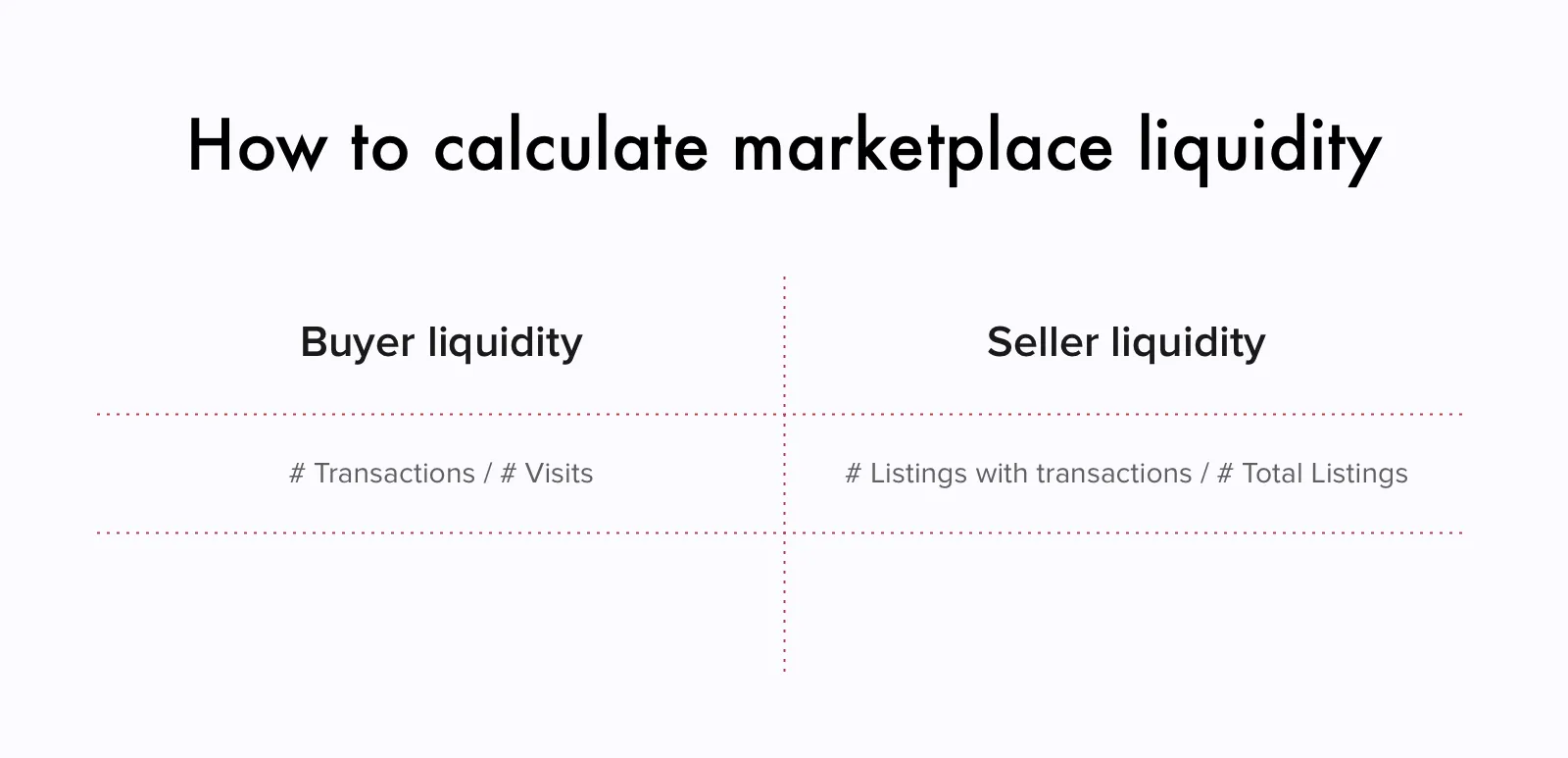

Exploring the Key Components of Effective Liquidity Models in Online Marketplaces

Effective liquidity models are crucial for the success of online marketplaces, as they directly influence the ease of transactions and overall user satisfaction. These liquidity models typically consist of several key components, including market depth, spread, and transaction velocity. Market depth refers to the currency availability and the number of buyers and sellers in the marketplace, ensuring that transactions can occur with minimal delays. A tight spread, or the difference between the bid and ask price, can enhance liquidity by making it cheaper for users to buy or sell assets. Lastly, transaction velocity, or the speed at which trades occur, plays a significant role in maintaining active trading environments and attracting more participants to the marketplace.

In addition to understanding these components, online marketplace operators must implement strategies to optimize their liquidity models. This can involve utilizing automated market makers (AMMs) to facilitate trades and ensure that there is always a sufficient supply of assets available for buyers. Regularly analyzing market trends and user behavior is also essential for making data-driven decisions that will enhance liquidity. Furthermore, creating an engaging user experience through intuitive interfaces and responsive customer support can significantly impact the marketplace's transaction rates and overall effectiveness of the liquidity model.

What Are the Best Practices for Ensuring Maximum Liquidity in Your Marketplace?

Ensuring maximum liquidity in your marketplace involves implementing several key best practices. First and foremost, diversifying your offerings is crucial. By providing a wide range of products or services, you attract different buyer segments, which increases the number of transactions. Additionally, consider creating an engaging pricing strategy; offering competitive prices can entice more buyers while also encouraging sellers to list their goods. Furthermore, employing a streamlined transaction process is essential. A user-friendly interface that facilitates quick and easy purchases helps maintain a high volume of trades and keeps users coming back.

Another essential best practice is to foster a robust community around your marketplace. Engaging users through social media platforms and effective customer service can enhance user retention. Providing regular updates, promotions, and incentives can motivate repeat transactions. Moreover, integrating real-time analytics ensures you can monitor trends and user behavior, allowing for timely adjustments to improve liquidity. Last but not least, consider forming partnerships with other businesses or platforms to enhance exposure and broaden your reach, driving even more potential transactions.