The 23rd World Insights

Exploring the untold stories and events from around the globe.

Term Life Insurance: The Ultimate Safety Blanket

Discover how term life insurance can be your ultimate safety blanket, providing peace of mind and financial security for your loved ones.

Understanding Term Life Insurance: Key Benefits and Features

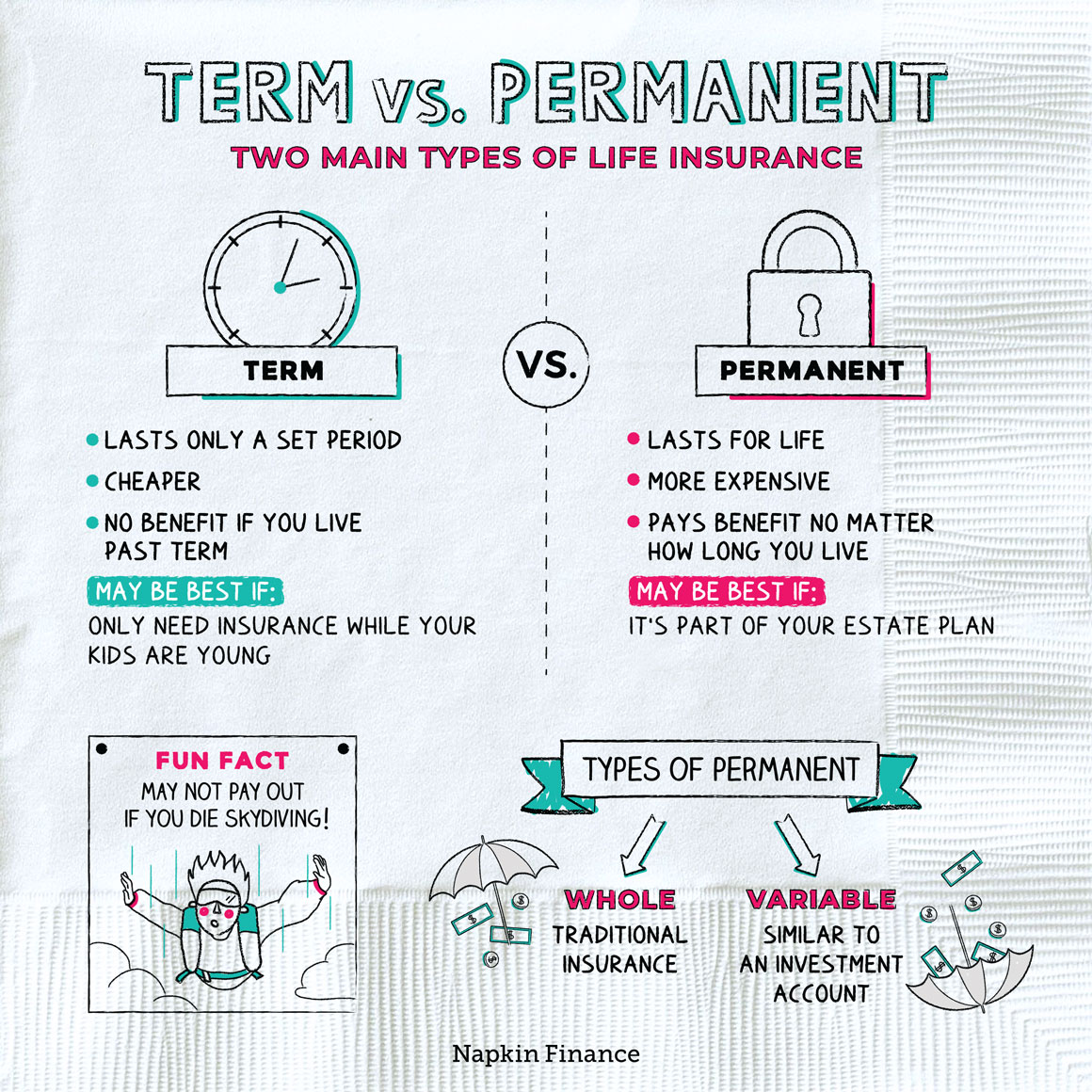

Term life insurance is a straightforward and cost-effective way to provide financial security for your loved ones in the event of your untimely passing. Unlike whole life insurance, term life policies are designed to cover you for a specified period, typically ranging from 10 to 30 years. This feature makes them an attractive option for young families or individuals with temporary financial obligations, such as a mortgage or education costs. The primary benefit of term life insurance is its affordability, allowing policyholders to secure a significant death benefit for a lower premium compared to permanent insurance plans.

In addition to affordability, term life insurance offers flexibility that can be tailored to match your evolving needs. There are various features you can choose from, such as convertible options that allow you to switch to a permanent policy if your situation changes, or renewable terms that let you extend coverage after the initial period. Moreover, the straightforward nature of term life policies makes them easier to understand, leading to informed decision-making when selecting the right policy. Ultimately, understanding the key benefits and features of term life insurance can empower you to protect your family’s future.

Five Common Misconceptions About Term Life Insurance

Term life insurance is often misunderstood, leading to several common misconceptions. Firstly, many people believe that term life insurance is only beneficial for young individuals or families with dependents. However, this coverage can be advantageous for individuals of all ages, providing a financial safety net regardless of life stage. Understanding the flexibility that term life insurance offers can help individuals better assess their personal financial needs and pave the way for securing future plans effectively.

Another widespread myth is that term life insurance is not worth the investment since it only pays out if the insured passes away during the term. In reality, this type of insurance is typically more affordable compared to whole life policies, making it a practical choice for those looking to protect their loved ones financially without breaking the bank. Additionally, the peace of mind that comes with knowing your family is covered can be invaluable, reinforcing the importance of considering term life insurance as a serious option for financial planning.

Is Term Life Insurance Right for You? Questions to Consider

Determining whether term life insurance is right for you requires a careful examination of your personal and financial circumstances. Start by asking yourself a few key questions:

- What are your financial obligations?

- Do you have dependents who rely on your income?

- How long do you need coverage for?

Another important factor to consider when evaluating term life insurance is your budget. Compare the cost of term life policies with your current financial situation and other insurance options. Keep in mind that term insurance typically offers lower premiums compared to whole life insurance, which may allow you to buy a higher coverage amount for the duration of your term. Additionally, assess your long-term financial goals and whether the protection offered by term insurance aligns with these aspirations, ensuring that you are making an informed decision.