The 23rd World Insights

Exploring the untold stories and events from around the globe.

Whole Life Insurance: Because Your Future Deserves a Backup Plan

Secure your family's future with whole life insurance. Discover why a backup plan is your best investment today!

Understanding Whole Life Insurance: Key Benefits for Financial Security

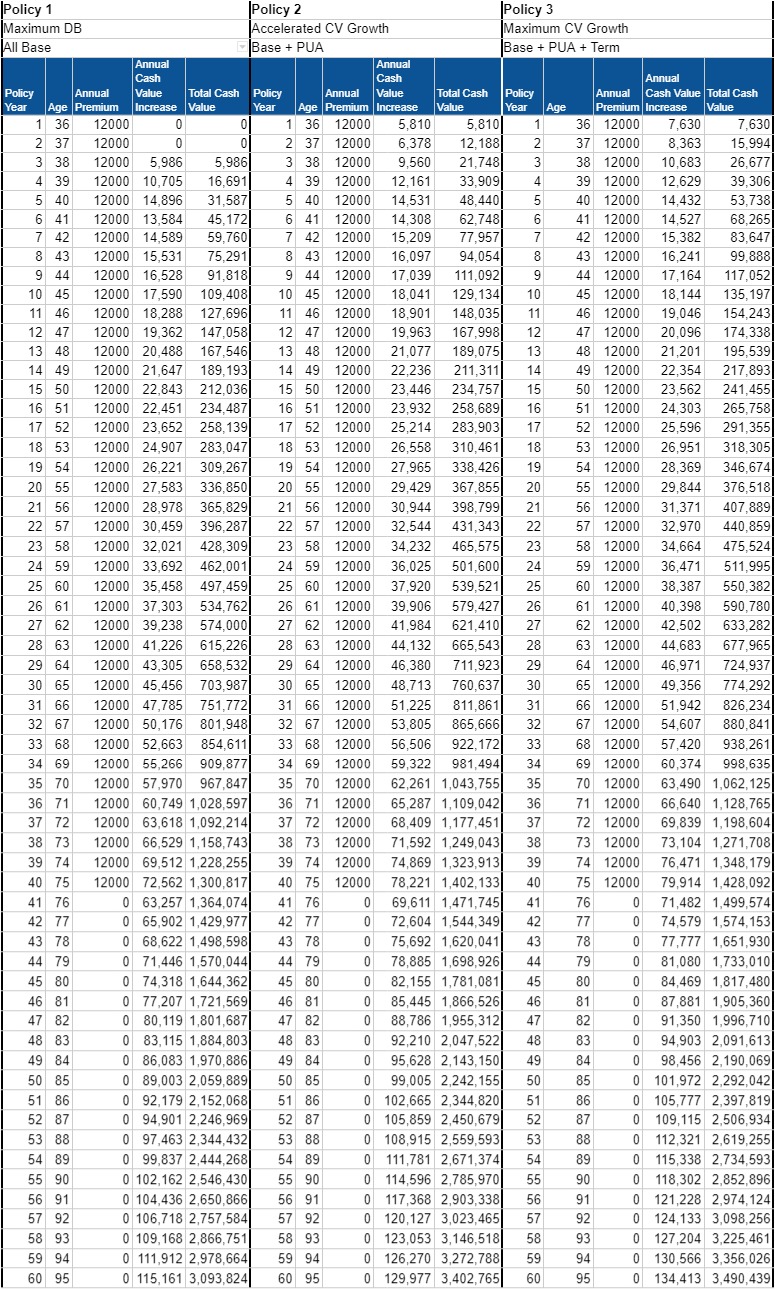

Understanding Whole Life Insurance is crucial for anyone seeking a reliable financial security plan. Whole life insurance is a type of permanent life insurance that provides coverage for the insured's entire lifetime, as long as premiums are paid. This policy not only assures a death benefit but also accumulates cash value over time. The cash value grows at a guaranteed rate and can be borrowed against, making it a significant asset as part of an individual's overall financial strategy.

The key benefits of whole life insurance include financial stability and peace of mind. With a whole life policy, your beneficiaries receive a death benefit that can help cover costs like funeral expenses, debts, and even ongoing living expenses. Additionally, the policy's cash value can provide liquidity during your life, allowing you to access funds for emergencies or significant life events. These features make whole life insurance a powerful tool in building long-term wealth and ensuring a secure financial future.

Is Whole Life Insurance Right for You? Essential Questions to Consider

When considering whole life insurance, it's essential to evaluate whether it aligns with your financial goals. Start by asking yourself if you require lifelong coverage that builds cash value over time. This type of policy can be a good fit for individuals seeking stable, long-term financial planning. According to Investopedia, whole life policies provide a death benefit and a savings component that can grow at a guaranteed rate, making it a unique blend of insurance and investment.

Additionally, assess your current financial situation and future obligations. Are you looking for a policy that can serve as an investment vehicle or do you simply need a safety net for your loved ones? It's advisable to consider your budget and the impacts of premium payments on your overall finances. For more insight, check out the comprehensive guide on Forbes, which outlines the pros and cons of whole life insurance, helping you determine if it's the right choice for you.

How Whole Life Insurance Provides a Safety Net for Your Loved Ones

Whole life insurance serves as an essential financial safety net for your loved ones by providing guaranteed death benefits and cash value accumulation. Unlike term life insurance, which expires after a certain period, whole life insurance offers lifelong coverage, ensuring that your family will be taken care of no matter when the policyholder passes away. This can be particularly important for covering funeral costs, outstanding debts, and maintaining the family's standard of living. By choosing whole life insurance, you are investing in your family's future security and peace of mind.

Additionally, whole life insurance policies accumulate cash value over time, which can be accessed through loans or withdrawals, providing a financial cushion during urgent situations. This feature allows policyholders to borrow against the cash value of their policy for various needs, such as unexpected medical expenses or education costs for children. Ultimately, the combination of lifelong coverage and cash value growth means that whole life insurance is not just a protective measure but also a strategic financial investment for your family. Achieving financial security and creating a lasting legacy has never been easier with the right whole life insurance policy.