The 23rd World Insights

Exploring the untold stories and events from around the globe.

Putting the 'Right' in Life Insurance: Term Edition

Unlock the secrets of term life insurance and find out how to choose the right policy that protects your loved ones and fits your budget!

Understanding Term Life Insurance: Key Benefits and Features

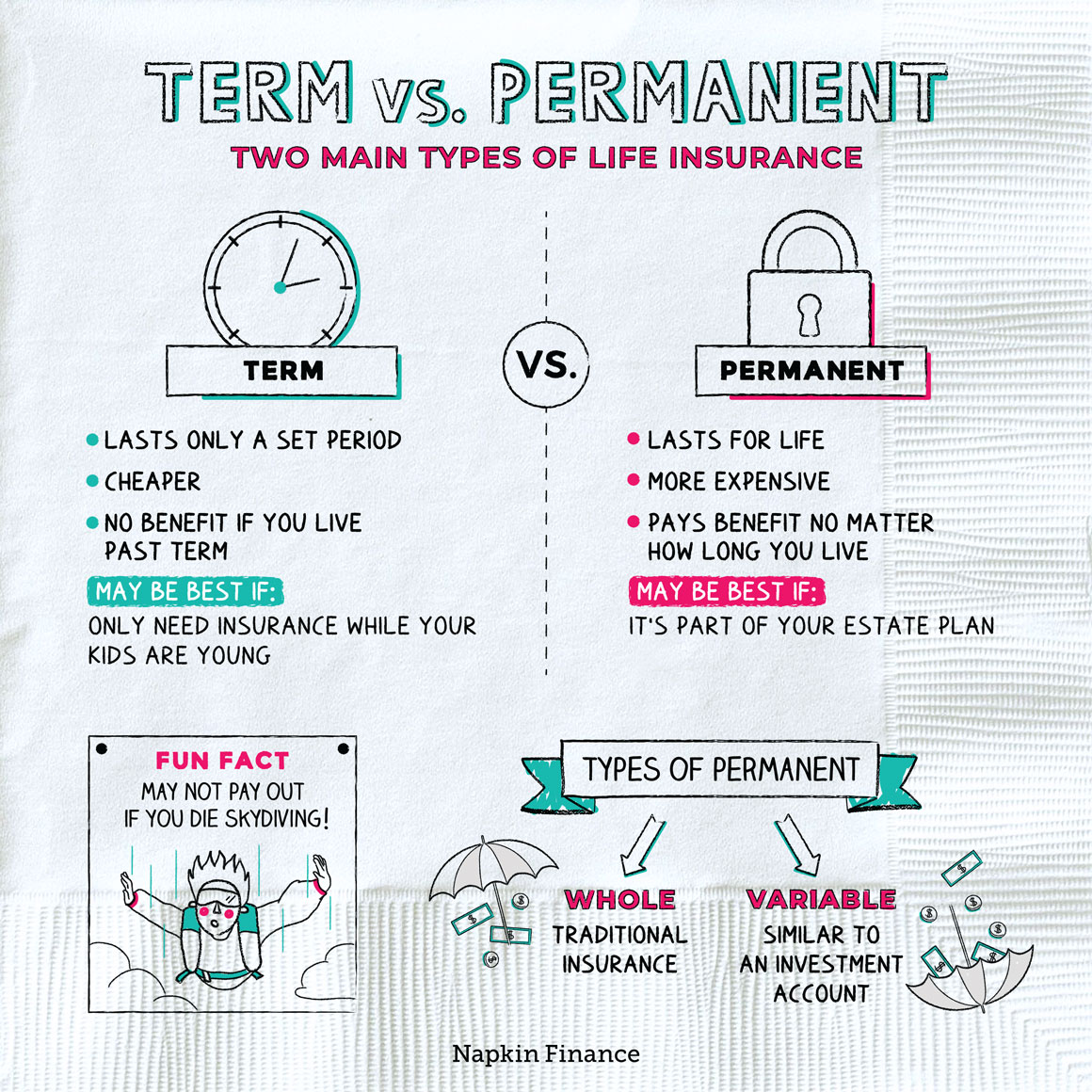

Term life insurance is a type of life insurance policy that provides coverage for a specified period, or 'term', typically ranging from 10 to 30 years. One of its primary benefits is affordability; compared to whole life insurance, term policies generally come with lower premiums, making it easier for individuals and families to secure financial protection without stretching their budget. Additionally, term life insurance is straightforward and easy to understand, as it offers a death benefit to beneficiaries if the policyholder passes away during the term. This simplicity makes it an ideal choice for those seeking basic coverage without the complexities often associated with permanent life insurance plans.

Another significant advantage of term life insurance is its flexibility. Policyholders have the option to convert their term policies into permanent policies as their needs evolve, ensuring continued coverage even after the initial term expires. Furthermore, many term life insurance policies allow for the addition of riders, such as critical illness or accidental death benefits, enhancing the coverage according to personal requirements. In summary, understanding the key benefits and features of term life insurance can help individuals make informed decisions, ensuring that they choose a policy that best fits their financial goals and provides peace of mind for their loved ones.

Is Term Life Insurance Right for You? Factors to Consider

When contemplating whether term life insurance is right for you, it is essential to assess your personal circumstances and financial goals. Start by considering your current life situation: Are you the primary breadwinner, do you have dependents who rely on your income, or are you planning to secure a financial future for your children? These factors significantly influence the type of coverage you may need. Additionally, evaluate the duration for which you require coverage. Term life insurance is ideal for those looking for affordable premiums and coverage for a specific period, such as until your children are grown or your mortgage is paid off.

Another crucial factor to contemplate is your overall health and lifestyle. Generally, term life insurance policies require a health assessment, meaning your premium rates can vary based on your health status, age, and lifestyle choices. For healthy individuals, term life insurance can offer an economical way to obtain a substantial death benefit for the duration of the policy. Moreover, consider your long-term financial objectives—if you're looking for permanent coverage, you may want to explore whole or universal life insurance options. However, understanding the potential cost savings and flexibility of term policies can help you make an informed decision that aligns with your financial planning.

A Comprehensive Guide to Choosing the Right Term Length for Your Life Insurance

Choosing the right term length for your life insurance can significantly impact your financial security and peace of mind. Typically, life insurance policies offer term lengths ranging from 10 to 30 years, but selecting the best option depends on personal circumstances. Consider factors such as your age, health, and financial responsibilities. For example, if you are a young parent, a 20 or 30-year term might provide long-term coverage during your children’s formative years, ensuring that they are financially protected in case anything happens to you. Alternatively, if you're nearing retirement, a shorter term could suffice to cover any remaining debts.

In addition to age and personal circumstances, evaluating your financial obligations plays a crucial role in deciding the appropriate term length. Start by creating an inventory of your current and anticipated expenses, including mortgage payments, education costs, and other debts. You may also want to consider your projected income growth and any changes in your household dynamics, such as marriage or having more children. The right term length for your life insurance should ideally align with these factors, offering sufficient coverage to safeguard your family’s financial future without overextending your budget.