The 23rd World Insights

Exploring the untold stories and events from around the globe.

Forex Frenzy: Riding the Currency Rollercoaster

Join the Forex Frenzy and discover how to profit from the wildest currency rollercoaster! Don’t miss out on the thrills and tips!

Understanding Currency Pairs: The Basics of Forex Trading

Understanding currency pairs is fundamental to grasping the dynamics of Forex trading. In the foreign exchange market, currencies are traded in pairs, where one currency is quoted against another. The first currency in the pair is known as the base currency, while the second is called the quote currency. For instance, in the currency pair EUR/USD, the Euro (EUR) is the base currency, and the US Dollar (USD) is the quote currency. This notation helps traders understand how much of the quote currency is needed to purchase one unit of the base currency.

Currency pairs are typically classified into three categories: major pairs, minor pairs, and exotic pairs. Major pairs involve the most traded currencies, such as the Euro, US Dollar, and Japanese Yen, and generally have high liquidity and lower spreads. Minor pairs, on the other hand, do not include the US Dollar and involve less commonly traded currencies. Exotic pairs consist of a major currency paired with a currency from a developing economy, which can present unique trading opportunities but often come with higher risk due to lower liquidity. Understanding these categories is crucial for effective Forex trading.

Top 5 Strategies to Navigate the Forex Market Like a Pro

Navigating the Forex market requires a strategic approach to stay ahead of the fluctuations and capitalize on profit opportunities. Here are top 5 strategies to help you trade like a pro:

- Develop a Trading Plan: Establish a solid trading plan that outlines your goals, risk tolerance, and strategies. This will act as your roadmap in the ever-changing Forex landscape.

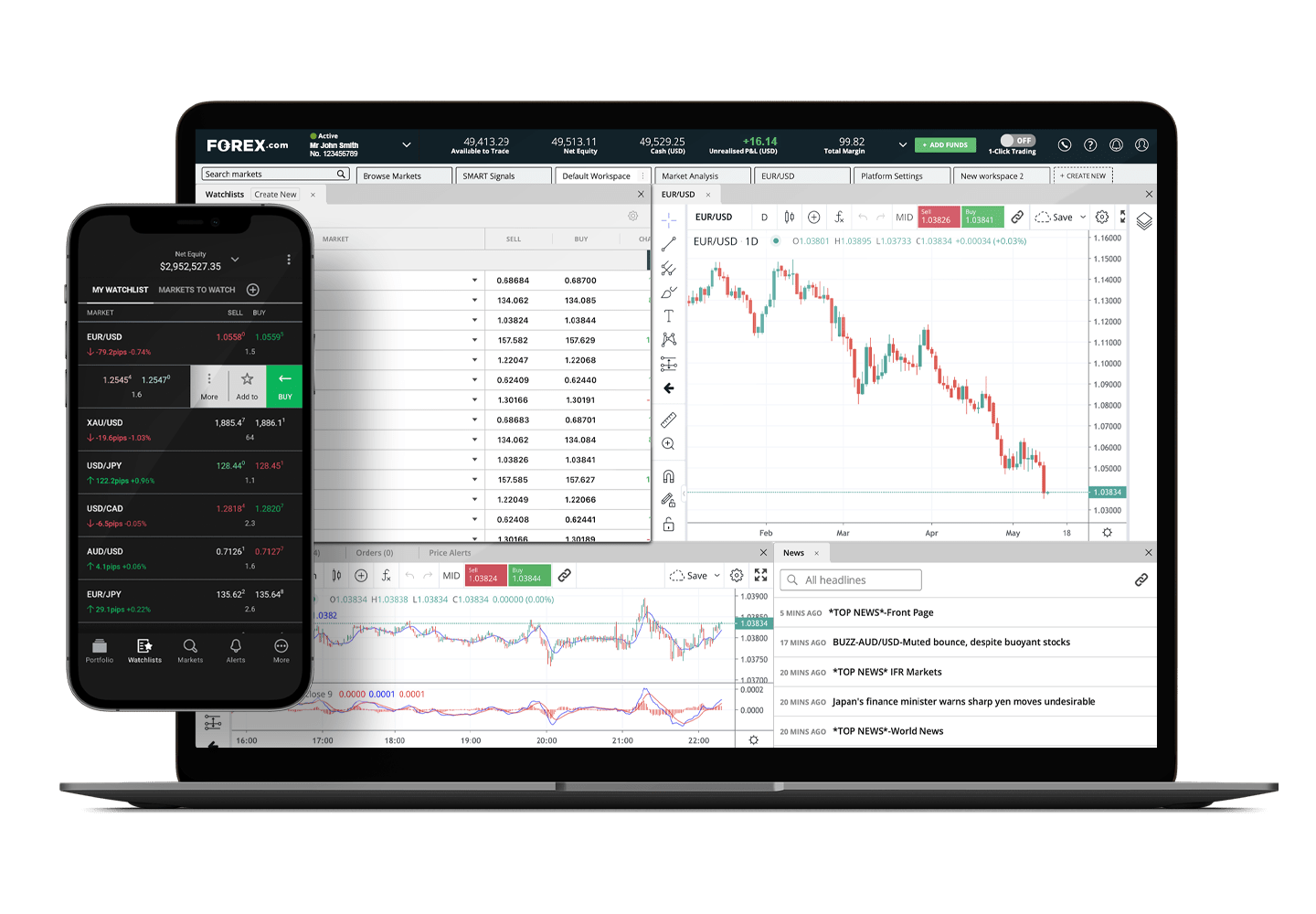

- Use Technical Analysis: Employ technical analysis tools such as charts and indicators to identify market trends and entry/exit points.

- Keep an Eye on Economic Indicators: Stay informed about economic events and announcements that can impact currency values, as they provide important insights for making informed trades.

- Risk Management: Always implement strict risk management techniques, such as setting stop-loss orders, to protect your capital and minimize losses.

- Continuous Learning: The Forex market is dynamic and ever-evolving, so it’s crucial to engage in continuous learning through resources, webinars, and market news to refine your trading skills.

What Makes Forex Market Volatile? Key Factors Explained

Forex market volatility refers to the fluctuations in currency prices, which can be attributed to a variety of factors. One of the primary drivers is economic indicators, such as employment rates, GDP growth, and inflation data. These indicators provide insight into the economic health of a country, influencing investor confidence and demand for its currency. Additionally, interest rates play a crucial role; when central banks alter interest rates, it often results in significant price movements, as traders react to the potential for higher returns. Moreover, unexpected geopolitical events and natural disasters can further exacerbate volatility by causing uncertainty and prompting swift reactions from market participants.

Another key aspect affecting volatility in the Forex market is market sentiment. This includes the attitudes and perceptions of traders toward current and future market conditions. For instance, if traders believe a currency is poised to strengthen, increased buying pressure can lead to price surges. Conversely, widespread fear or negative sentiment can lead to sharp declines. Additionally, speculation also contributes significantly; as traders buy and sell currencies based on anticipated movements rather than fundamental data, it increases the frequency and intensity of price changes. Understanding these factors is essential for traders looking to navigate the complexities of the Forex market.